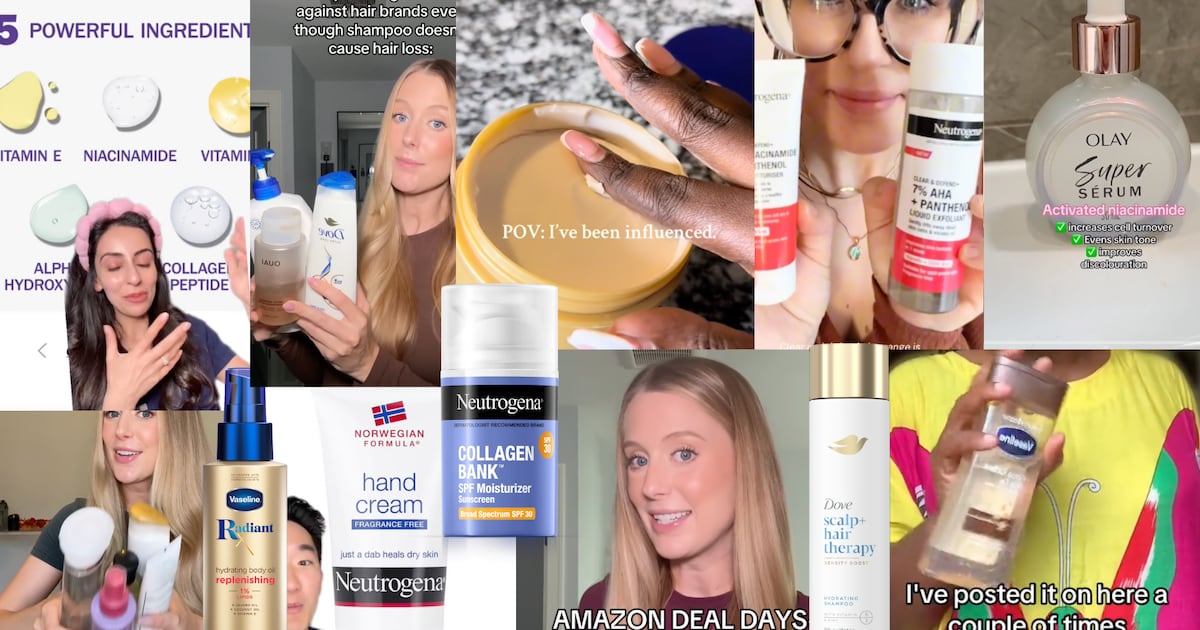

The million-plus people who follow Abbey Yung, a content creator with thick, waist-length blonde hair on TikTok are constantly inundating her with the same question: What products does she use to make her hair so soft and shiny?

Yung’s secret actually isn’t such a secret at all: Most of her recommendations are from affordable, mass-market brands like Dove.

“I’m not exaggerating when I say this literally made my hair feel like liquid silk,” gushes Yung in a video about its Bond Strength conditioner, $3.98.

The Unilever-owned hair care brand doesn’t fit the traditional blueprint for a buzzy brand. It’s not new (the company has existed since the 1950s) or exclusive (the brand can be found everywhere from Walmart to drug stores) and its products don’t boast any rarefied ingredients.

But as Cerave showed, a no-frills and accessible image can be a foundation for virality. In recent years, the L’Oréal-owned skincare brand has gone from an unexciting line distributed mainly in dermatologist’s offices to a billion-dollar brand, thanks to a combination of smart branding and tapping into the burgeoning popularity of professionally-recommended skincare — plus a handful of viral stunts.

Lisa Payne, head of beauty at trends agency Stylus said Cerave’s success on social media was partly driven by a trend towards “unsexy products”, which has seen more pedestrian and functional formulas like Cerave’s $15 moisturisers or $14 cleansers (all its products are under $20) becoming coveted items. Another factor is that Cerave was able to leverage the endorsements of its pre-existing dermatologist network and establish the brand’s scientific credibility while mobilising a growing cohort of “medfluencer” creators.

This playbook is easily replicable for other mass brands, who have the opportunity to bask in Cerave’s “halo effect” — but execution is key. There are already built-in consumer trust mass brands, especially those that have been around for decades like Olay and Vaseline. But they don’t necessarily have the same reputation for efficacy or suitability for young skin that’s key to growing reach, said Payne. “There’s this perception that they’re harsher or more chemical,” she said.

The sweet spot for mass brands wanting to go the way of Cerave is to appeal widely and authoritatively. But this requires a careful calibration of marketing, product development and pricing strategies — as well as timing — to ensure they hit the right note.

Education, Education, Education

Originally founded in 2005, Cerave had less than $200 million in sales by 2017, the year it was acquired by L’Oréal for $1.3 billion. (The deal also included two other brands, Acnefree and Ambi, which L’Oréal no longer operates.) Momentum picked up, however, interest in skincare surged during the pandemic; the brand’s sales rose 82 percent in the first nine months of 2020.

Splashy advertising campaigns followed, hitting a zenith with a Super Bowl commercial starring actor Michael Cera in February. But for consumers to care about Cerave, they had to care about ceramides, naturally occurring fatty acids that help the skin retain moisture and softness, and Cerave’s namesake. Much of the brand’s marketing effort has been spent explaining what ceramides are, how they work in the skin, and crucially, how suitable they are for all skin types.

Cerave weren’t the first brand to use ceramides, but their consistent messaging and clear education helped make them ownable. This formula can work for other brands and ingredients — Payne said many customers shop for specific ingredients in skincare, body care and hair care before they look for brands or price points, and some retailers now merchandise beauty products by their key ingredients, like hyaluronic acid.

As consumer interest around specific ingredients like niacinamide, azelaic acid and peptides continues to grow, there’s opportunity for brands to take an educational role and be the strongest and best communicator — if not the first.

To herald the launch of its Scalp + Hair Therapy range, Dove partnered with Yung (who is a qualified trichologist and had previously posted organic unpaid content about the brand) as well as dermatologists Mona Gohara and Marisa Garshick for a media campaign that saw giftees receive a personalised digital microscope so they could track their scalp’s process with usage.

Vaseline says its Radiant X body care line, which contains skincare ingredients like Vitamin C and niacinamide and is designed for darker skin tones, has been co-created with dermatologists who specialise in the field. Kenvue-owned Neutrogena — which lost its long-held title as the most dermatologist-recommended brand to Cerave in 2021 — launched a new campaign in June designed to get Gen-Z consumers interested in their skin’s collagen levels. Neutrogena also recently signed Muneeb Shah, a dermatologist with 18 million TikTok followers and former Cerave spokesman who appeared in the Super Bowl ad, to a multi-year partnership, in part to help build a “proactive and engaged community of consumers and influencers.”

Keep It Simple

The simplicity of Cerave’s branding, as well as its products, also helped it become a mega-brand. Scott Markman, founder and president of branding agency Monogram Group, commends the brand on its simple visual identity.

“It’s just this white packaging with a standout logo, but it creates these great building blocks,” he said.

Differentiating each range by colour — blue for moisturising, green for oil control, orange for sun protection — has also helped the brand stand out on the shelf and easily communicate to the consumer what any extensions to its core range were for. That goes a long way towards cementing a brand identity and making its core tenets memorable and consistent, said Markman. “The main key here is focus…whether it’s five SKUs or 50, the more you stick to your [identity], the more you can defend it,” he said.

Its promotional format was also simple and replicable. The brand would work with science communicators, primarily dermatologists, to create TikTok and Instagram content explaining why the products worked and giving them an expert recommendation. The brand didn’t escalate to its more attention-grabbing stunts, like the Super Bowl commercial or viral comedy skits, until it was well established and generally well understood by consumers.

Price Point Performance

Cerave’s products might be sold in drugstores, but they’re still a more premium offering than other mass brands — a cleanser might be $15 to Neutrogena’s $9.

Premiumisation has been a growth engine for beauty brands, both by increasing their overall net sales, and also by helping to increase their standing amongst consumers. Leandro Barreto, Unilever’s global beauty chief marketing officer, said that’s been a driving force for Vaseline, which focussed additional benefits into line extensions rather than the core brand to avoid alienating long-time customers. “The centre of our strategy is education, new benefits and new formats,” he said. We can ask consumers to pay more for that, but not necessarily price increase in the core items.”

It’s a fine line, said Payne, adding that consumers may want to see substantial benefits alongside higher price points, such as a concept that’s new to the market or sustainable positioning. She adds that another key to the viral success of many mass brands is the thrill of getting a bargain — a thrill that is intensified by a product’s perceived value.

The top spot will always be hotly contested, and even top brands have to keep evolving to keep consumer attention — the growth of L’Oréal’s dermatological beauty division, which houses Cerave, has cooled somewhat with both a pullback from US drugstores, a key distribution channel, and a harder competitive climate cited by L’Oréal’s leadership.

“[Cerave] has to be prepared for a boomerang effect from the competition,” said Markman. “Competitors don’t stand still.”

Sign up to The Business of Beauty newsletter, your must-read source for the day’s most important beauty and wellness news and analysis.