Opens in new window

Opens in new windowThe volume of choice is working against fashion brands, negatively affecting conversion as shoppers increasingly abandon carts. 74 percent of customers report walking away from online purchases due to the volume of choice.

In response, some retailers have reduced the size of their offering to increase relevancy and reduce choice paralysis. Asos, for example, announced it will offer fewer but more relevant brands to customers, reducing stock intake by 30 percent year on year in the first quarter of 2024, and is planning a further 16 percent reduction in stock by the end of 2024.

Search remains the primary mode of online product discovery. 69 percent of customers state they go directly to a retailer’s search bar when shopping online. However, 80 percent are dissatisfied with the search experience and leave the site as a result. 41 percent cite irrelevant results as a main barrier to shopping.

Fashion brands are starting to address the challenges by using generative AI. While promising, these efforts are a work in progress. Revolve has reported significant increases in customer engagement from its experiments with generative AI-powered search. Kering, on the other hand, introduced Madeline, a ChatGPT-powered shopping assistant, in 2023 on KNXT, a site it uses to test digital innovations, only to later disable the feature.

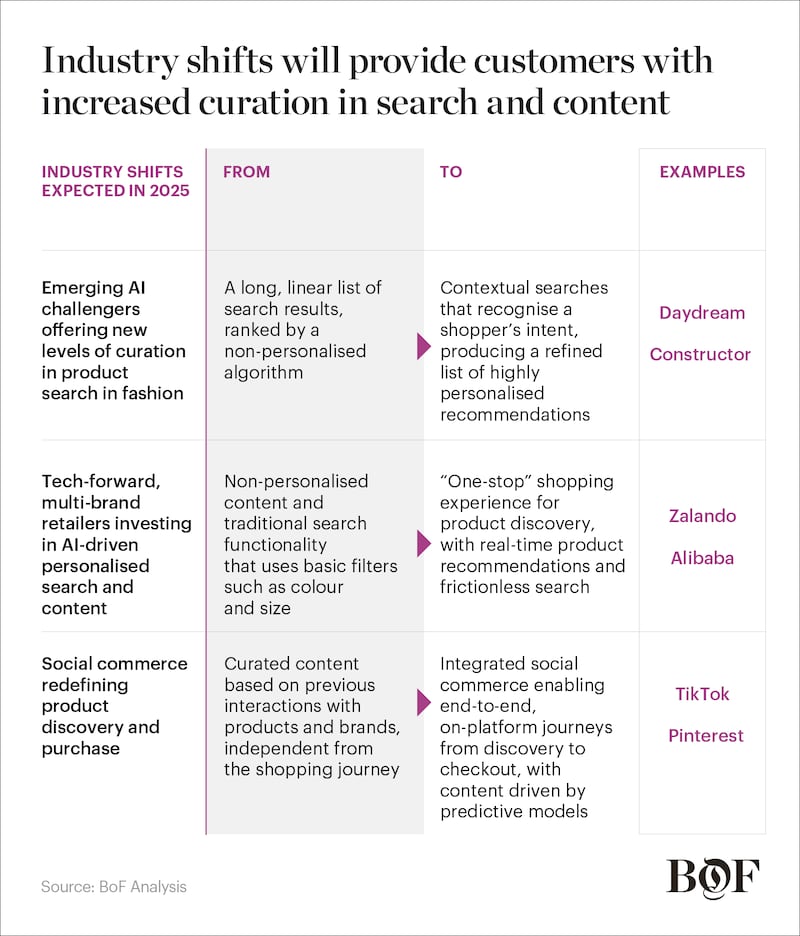

In The State of Fashion 2025, BoF and McKinsey explain how industry shifts and technology developments are set to offer customers increased curation in search and discovery in the year ahead.

Reinventing product discovery will be a key focus area for fashion players in 2025

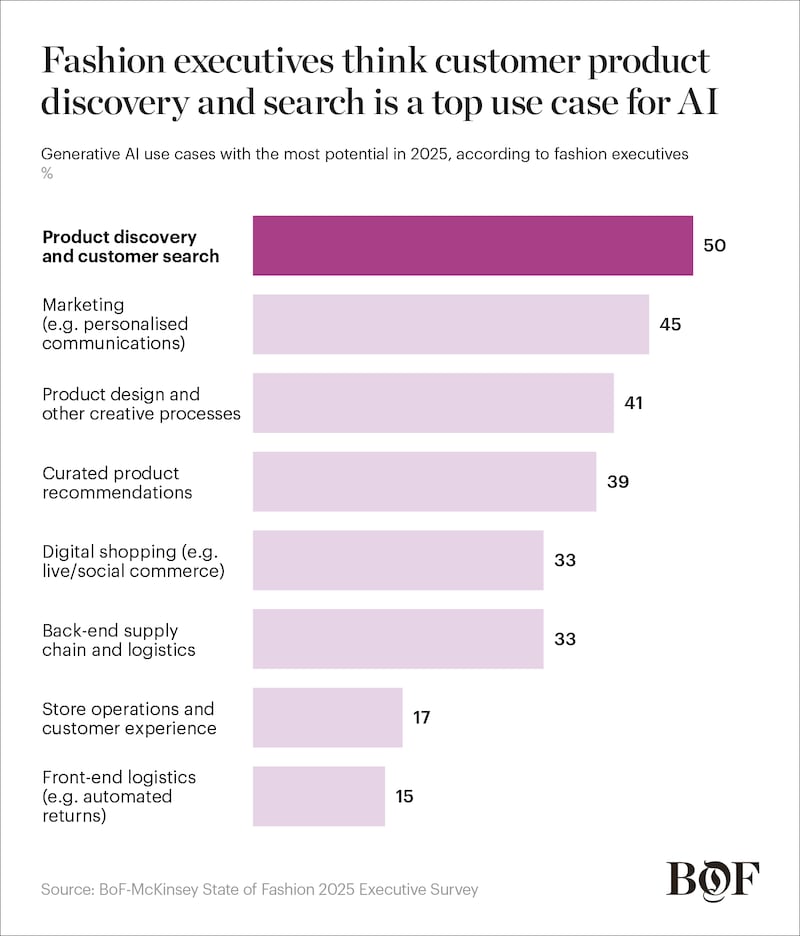

Customer product discovery and search is the top-ranked use case for generative AI in 2025, according to fashion executives.

This is thanks to a number of converging factors:

Growing customer demand for AI-powered shopping experiences

79 percent of customers surveyed by Google say they would find it helpful for AI to understand their specific needs and recommend products. 82 percent say they want AI to reduce their time spent researching what to buy. To address this, 84 percent of organisations say hyper-personalised experiences across customer touchpoints are a priority for the next 12 months.

Increased competitiveness in quality and cost

Intense competition among technology players such as Google, Meta and OpenAI has driven significant improvements in model quality while decreasing their cost-to-deploy. Google DeepMind’s latest AI model, Gemini, will offer AI overviews featuring refined recommendations, multi-step reasoning, planning and multi-modal capabilities. In October 2024, the company introduced a new shopping experience centred on AI features such as a personalised shopping feed and guides that summarise relevant product information. Meta has also upgraded its open-source AI model, Llama 3.1, with monthly users increasing 10x from January to July 2024.

Greater accuracy of AI tools

Competition has also driven accuracy improvements. For example, OpenAI’s GPT-4o is 15 to 20 percent more accurate than previous models, generating fewer hallucinations across a range of tasks. Similarly, start-ups such as Anthropic are entering the space with models such as Claude 3.5 Sonnet, demonstrating greater accuracy compared to incumbent models.

Emerging commercial success stories

While experiments have produced mixed results, some brands have started to realise the impact of AI investments on product discovery and their bottom lines. Zalando credited an 18 percent year-on-year increase in profitability in the second quarter of 2024 in part to the roll-out of several generative AI features aimed at lowering costs and increasing customer engagement, including a ChatGPT-powered shopping assistant, personalised product recommendations and curated content.

Emerging AI challengers are redefining product search for the fashion industry

AI-powered shopping platforms

Daydream

Brands and retailers have recognised the power of optimising search to solve for consumers’ increasingly contextual and colloquial search terms, leveraging natural language prompts to curate a shortlist of relevant options.

Daydream leverages generative AI, machine learning and computer vision to deliver highly personalised search results using natural language and image recognition with detailed product catalogues. Daydream has raised $50 million in seed funding and closed partnerships with brands such as Alo Yoga, Jimmy Choo and Dôen, among others, with the objective of launching a beta version in Autumn 2024.

More than 2,000

— brands and retailers onboarded for Daydream’s pre-beta launch

Capsule

Consumers are using multiple modes of search, such as image recognition, to identify looks they want to shop. The likes of Google and Amazon leverage this technology, while new start-ups such as Y Combinator-backed Capsule are focusing on perfecting these alternative search methods for fashion discovery.

Capsule’s on-demand product discovery platform includes a unique product index, based on over 20,000 scraped data points per day. The app works similarly to the music app Shazam, using computer vision and deep learning to identify similar styles to those uploaded by users.

99%

— of user images uploaded to Capsule in launch week matched with shoppable links

AI-powered discovery partners

Constructor

Increased appetite among brands and retailers to enhance the online customer experience has sparked interest in AI partnerships with players such as Lily AI, Bloomreach, Vantage Discovery, Constructor and others.

Constructor’s B2B platform enables brands and retailers to embed AI in product search. Valued at $550 million, it has tripled revenues since 2022. Constructor partners with brands such as Under Armour and Birkenstock to deliver personalised search experiences and has powered more than 100 billion customer interactions in the first six months since launch.

20x

— increase in return on investmentfor some brands when using Constructor’s AI product search

Multi-brand retailers with vast product data are driving change in content curation

Taobao and Tmall, Alibaba Group

Alibaba set up a “digital tech” firm under its e-commerce unit TTG in August 2024.

Search: Taobao and Tmall Group (TTG) introduced Wenwen, a large language model chatbot that provides personalised recommendations to consumer queries using multi-modal outputs such as text, image, video and audio, and is the first fully integrated AI e-commerce user application in China. Wenwen was used more than 1.5 billion times in one month during the 11.11 shopping festival in 2023.

Content: The platform’s curated content and personalised short inspiration videos has improved its click-through rate.

30%

— improvement in click-through rate with personalised content on Wenwen

Zalando

Zalando is investing in generative AI to become a “one-stop” destination for customers, spanning both product discovery and inspiration as well as seamless search.

Search: Zalando’s AI assistant, which leverages ChatGPT technology, has been used by over 500,000 customers since its launch in 2023. It leverages data from ongoing interactions with users to refine and improve output and accuracy over time.

Content: Zalando Stories use generative AI to show curated content to users based on real-time data. Similarly, Trend Spotter, a B2B tool, identifies emerging trends on Zalando across six fashion capitals, enabling brands to create styles and content that resonate with real-time customer preferences.

Over 7M

— new users since Zalando acquired lifestyle publication Highsnobiety as part of its shift towards enhanced content curation

Social media will continue to change the way shoppers discover and purchase fashion

Brand discovery through social media is now equally as common as through search engines, with 38 percent and 37 percent of customers using the discovery methods, respectively. While in-app shopping on social media is a core part of the e-commerce market in China — short video app Douyin has a 15 percent e-commerce market share and saw total transaction volume grow by 256 percent in 2023 — social commerce has yet to pick up pace in the US and Europe.

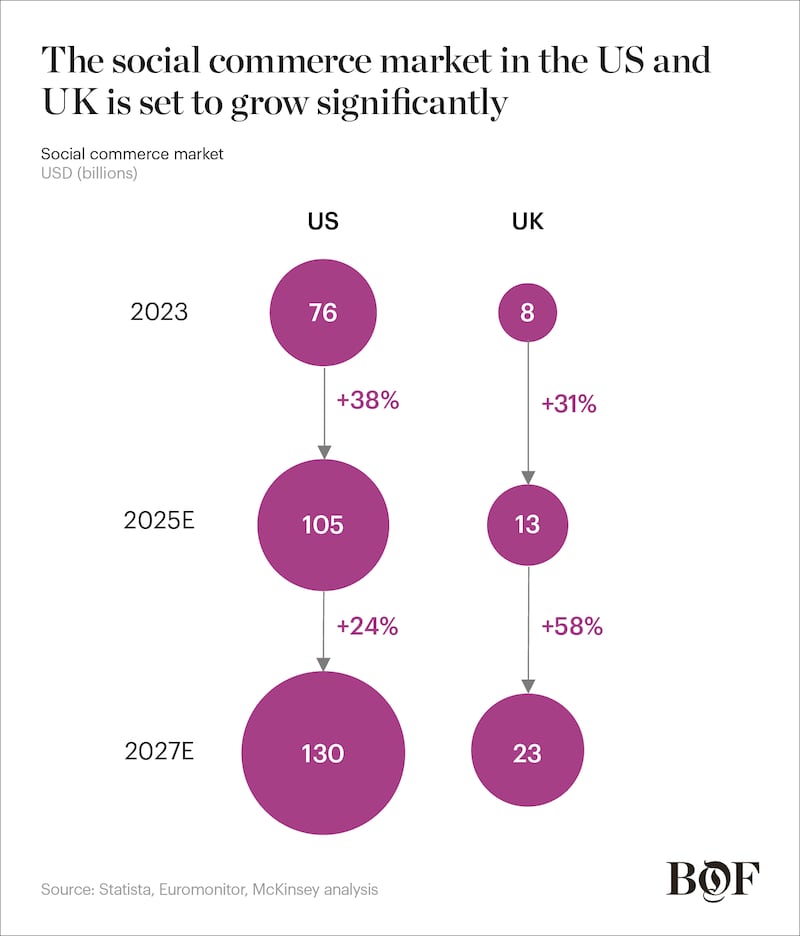

However, social media’s growing role in discovery may finally unlock its potential in the West in 2025. The social commerce market in the US and UK is expected to almost double by 2027. This is due to:

- Predictive algorithms: The TikTok algorithm is distinct in its focus on content discovery with the “For You” page predicting what users will enjoy based on their individual preferences, enabling them to explore new brands and products.

- Content tools: TikTok Shop has launched a suite of generative AI creative solutions for brands to produce quality content faster, enhancing commercial prospects for brands.

- Integrated shopping journeys: TikTok Shop had 33 million users in the US in 2023, up 40 percent since 2022. It is estimated that approximately 43 percent of users will purchase through the platform by 2027. Following its launch on TikTok Shop, brand Princess Polly generated a 350 percent increase in purchase value and a 5x increase in purchase frequency through targeted search, with 60 percent of customers new to the brand.

Pinterest credits its AI investments in in-app commerce for making the platform more shoppable, including features such as AI Collage, which enables shoppers to curate shoppable content. On Pinterest, posts with shoppable products are 300 percent more likely to generate engagement. It also plans to invest in a dynamic AI ad solution that will allow brands to optimise adverts in real time, prioritising users and products with the highest return.

How should executives respond to these shifts?

1. Build AI foundations

Embed AI literacy in the hiring criteria for adjacent roles, such as in marketing functions, in relation to customer experience and brand perception. Upskill the existing workforce on the appropriate use of AI.

Establish a technology backbone (including tech stack and infrastructure) that provides flexibility to adopt and scale search and discovery use cases.

Identify relevant tech partners for cost-effective generative AI deployment or build in-house capabilities through acquisition. Ensure product data is optimised for AI search, identifying relevant product features and attributes, for both organic search and content-led discovery.

2. Prioritise value and accuracy, then scale

Apply a prioritisation framework to identify the discovery and search use cases with the highest value based on customer insights. Employ a test-and-learn approach, starting with use cases that perform specific tasks with consistently accurate results before scaling more broadly across a larger customer base or set of activities.

Assess on an ongoing basis the trade-offs retailers may need to make between showing customers the most relevant products to improve conversion and monetising search results by allowing brands to sponsor listings.

3. Manage risks and ethics

Implement AI best practice frameworks to guide teams through the appropriate use and communication of AI in content and search to gain customer trust.

Consistently monitor how AI models are developed and trained, incorporating broader data sets that consider all customers. Monitor search accuracy and model output through human validation and A/B testing to ensure resonance with customers. Balance changes with brand tone of voice, prioritising authenticity and avoiding rigid algorithm-driven outputs.

This article first appeared in The State of Fashion 2025, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.